Ask the audience: can you see an end to the cost-of-living crisis?

How do audiences feel the economic crisis is impacting their disposable income? Are they feeling positive about the future? David Brownlee’s analysis reveals varied expectations for the next six months

The second anniversary of the UK’s cost-of-living crisis isn’t worthy of a celebration, but it is a good time to reflect on how audiences feel it has affected their disposable income.

In October 2023, we added a new question about changes in financial circumstances in the past two years to the monthly survey we conduct on behalf of 37 venues around the UK. We received 724 responses.

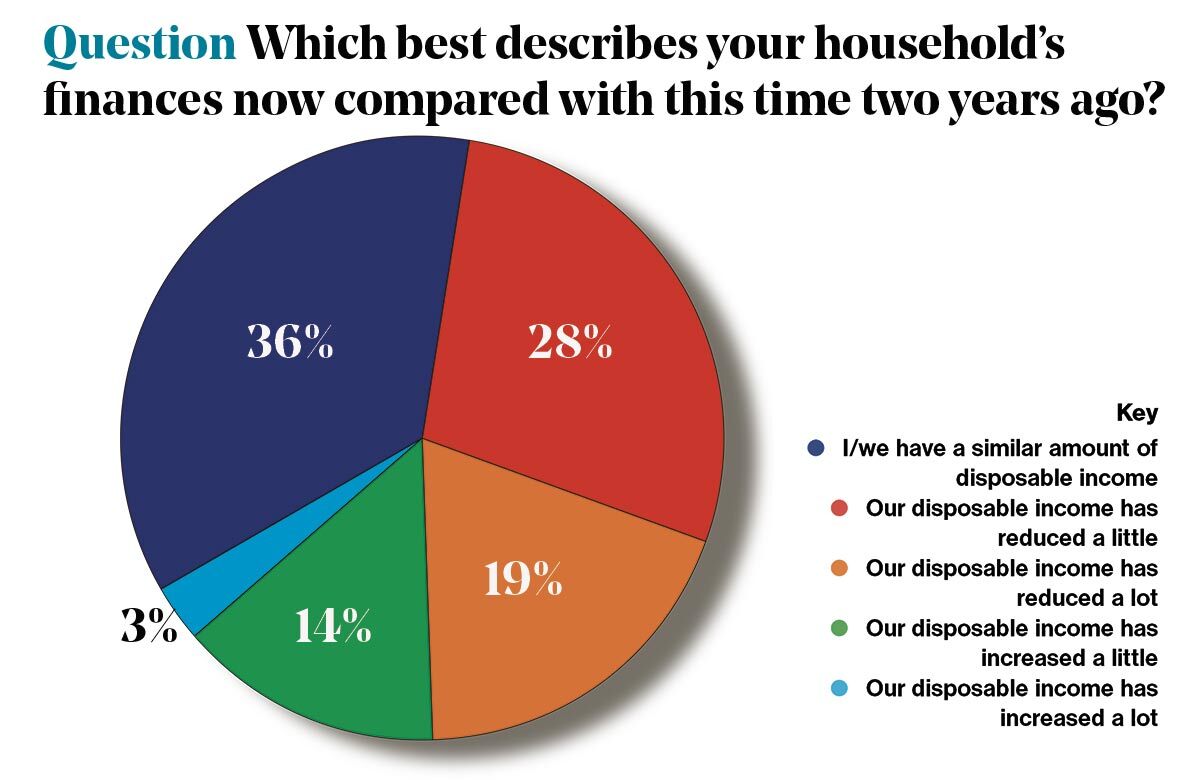

We asked: Which best describes your household’s finances now compared with this time two years ago?

Regular readers of this feature won’t need reminding that this is not a representative survey of the population. Respondents are theatregoers who tend to be more frequent and recent attenders than ‘average’ bookers. While almost half reported a fall in their disposable income (47%), it is important to note that 17% of our respondents stated it had actually increased in the past 24 months.

We then asked our respondents: Which best describes your current feelings about your household’s finances over the next six months? The outlook for respondents was clearly driven by their experiences in the past two years.

Continues...

Of the 3% of respondents who reported a significant increase in disposable income over the past two years, the majority (84%) don’t expect it to fall in the next six months. Sixteen percent expect it to fall either a little or a lot. The mean age of respondents who reported a larger increase in disposable income was 57.

Around one in seven respondents to the original question (14%) said their income had increased a little over the past two years. Their mean age was also 57. While the majority of these respondents are optimistic about the next six months – 73% say they anticipate their status quo continuing – more than one in five (21%) expect a fall in their disposable income.

The largest group of respondents to the first question (36%) reported a similar amount of disposable income compared with two years ago. This group was also, on average, the oldest, with a mean age of 62. Again, the majority of these respondents (69%) are optimistic about the next six months, but one in five expect their disposable income to fall.

Theatre managers need to remember that a substantial minority of their audiences have more disposable income now than they had in 2021.

Just over one in four total respondents (28%) reported that their income had reduced a little in the past two years. The mean age of these respondents was 59. Almost two-thirds of these respondents (64%) expect their disposable income to reduce further over the next six months, while only a quarter (25%) anticipate it remaining the same.

Lastly, one in five of total respondents stated that their income had reduced a lot over the past 24 months. These respondents were on average the youngest, with a mean age of 55. They are the least optimistic about the next six months. The majority expect their income to fall further (43%), while another 17% say they have little or no disposable income at all. By comparison, 1% or fewer in each of the other four groups gave this answer.

To conclude, the cost-of-living crisis continues to have an impact on the financial confidence of many theatregoers. Those who state they have suffered most in the past two years are also more likely to predict further reductions in their disposable income over the next six months. On average, older bookers are the least likely to report that their disposable income has reduced, while younger bookers report the biggest reductions in their available spend.

Theatre managers need to remember that a substantial minority of their audiences have more disposable income now than they had in 2021. Maximising ticketing and philanthropic revenues from these customers can fuel initiatives to ensure there are affordable tickets for those who have lost most during the cost-of-living crisis and fear the most for the months ahead. ■

A note on methodology:

The Stage suggested additional questions on disposable income in the UK Performing Arts Audience Survey.

Currently, 37 participating venues across the UK collectively invite 20,000 participants (all of whom have attended the venue at least once in the past five years) to take part in the monthly survey. Data was collected from October 3-10, with a total of 724 respondents.

Participating venues include both commercial and not-for-profit organisations. As well as both producing and presenting theatres of all scales, concert halls are also represented. It’s a survey of theatre (and concert) goers, not the UK adult population as a whole. More recent and frequent bookers are more likely to respond to the survey.

The UK Performing Arts Audience Survey is managed by TRG Arts/Purple Seven on behalf of the 37 participating theatres. The questionnaire has been designed by Morris Hargreaves McIntyre and Data Culture Change. Analysis of responses and the writing of this report has been led by Data Culture Change.

Want to join the survey or ask a question? Email david@dataculturechange.com

Opinion

Recommended for you

Opinion

Recommended for you

Most Read

Across The Stage this weekYour subscription helps ensure our journalism can continue

Invest in The Stage today with a subscription starting at just £7.99