Campaign launched to save largest English-language theatre on European continent

The future of the largest English-language theatre in continental Europe is at risk, as a dispute over a lease renewal could result in the theatre being forced to close or relocate.

A petition has been set up to save English Theatre Frankfurt, which has more than 11,000 signatories.

Among those sharing their concern are UK creatives Tom Littler, who is the Orange Tree Theatre’s artistic director, and David Byrne, who is artistic and executive director of the New Diorama Theatre, with Byrne stating that ETF was a "lifeline" for UK talent.

Originally established in 1979, ETF’s 300-seat theatre has been located in the Gallileo building in Frankfurt since 2003. EFT has been housed rent-free by the venue’s previous owner, German bank Commerzbank, as part of commitment from the company to support the arts.

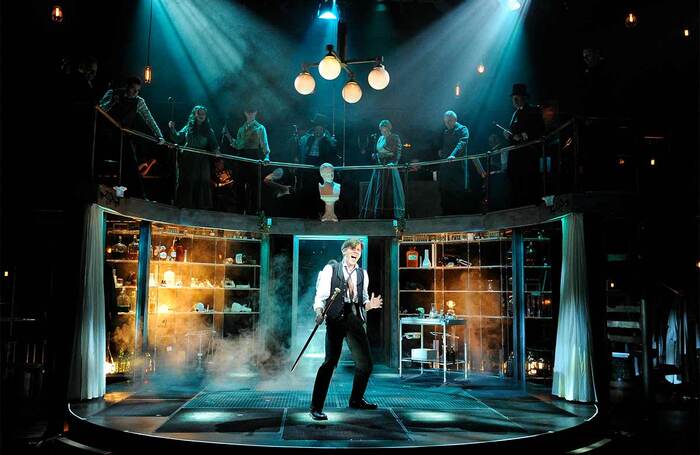

The venue runs a programme of English-speaking productions and predominantly hires a UK-based and English-speaking cast and creative team.

Commerzbank sold the building in 2015 to CapitaLand Investment but still acts as the theatre’s landlord until its lease ends on January 31, 2024.

Commerzbank’s sublease to ETF expires on April 15, 2023.

ETF had been caught in a "deadlock", artistic and executive director of the venue Daniel Nicolai said, with the organisation unable to seek a longer-term lease with CapitaLand until Commerzbank vacated, which would potentially leave the theatre company without a lease from April 15, 2023, to January 2024.

Nicolai said he "hoped a solution would be found by Christmas" as the cast of the venue’s new musical Sister Act, which runs from November 12 to April 2, 2023, was due to fly out to Frankfurt.

Continued...

Nicolai said he had "believed" that a new contract for the company would be on the table as the venue’s initial end-of-2022 lease date got closer, but the theatre had only been offered a mid-April extension with no further offers made by Commerzbank.

He added: "We are in a deadlock. We expect that [as mentioned] in the petition, the two companies will find the solution for this period and beyond."

Nicolai said that if the issue had not been resolved by April next year, "we will stay to present art and see what happens. Hopefully, by that time, something will be sorted".

Littler has worked on five productions at the venue, adding that ETF allowed him to work during the pandemic "when UK theatres were closed" due to restrictions.

Littler said: "For me, it was a really important space as it’s where I got to do large-scale work. Particularly on musicals and large-scale plays with levels of resources I often didn’t have access to in the UK, so it was very important for my development and probably for many other UK directors."

Byrne described working with the organisation as a "lifeline", especially during Brexit.

Commerzbank said that it had already offered to extend the sub-lease agreement for the English Theatre Frankfurt in the Gallileo tower from December this year through to April 15, 2023, therefore "ensuring that Frankfurt’s cultural institution does not have to close prematurely".

Commerzbank said that the original contract between Commerzbank and the English Theatre stated that the "financial support of the bank would expire at the end of 2022".

The bank said in a statement: "The English Theatre has been housed in Frankfurt’s Gallileo tower rent-free since 2003.

"While Commerzbank has merely been the tenant in Gallileo since 2013, it has nevertheless assumed the rental and operating costs for the theatre from the lease agreement for the duration of the tenancy.

"Over the years, the rental costs of the English Theatre borne by Commerzbank have totalled some €9 million, a figure that underlines the contribution made by Commerzbank to the promotion of education and the arts in Frankfurt."

The organisation claimed that the theatre’s management had been aware that the lease would be coming to an end, but it had not yet found a new sponsor or premises.

Commerzbank added: "Rather the ETF has expressed its expectation that it could continue to use the current premises free of charge. The owner of the Gallileo tower has not yet said that it would assume this obligation as the immediate landlord and thus guarantee the continued existence of the theatre."

CapitaLand were approached for comment.

Production News

Recommended for you

Production News

Recommended for you

Most Read

Across The Stage this weekYour subscription helps ensure our journalism can continue

Invest in The Stage today with a subscription starting at just £7.99